Can we carry drone to India?

Will the drone be confiscated by the airport customs ?

Is Drone photography/video permitted in India over public property ?

Indian drone regulations

Flying drones is now legal in India Official Drone Regulations

Drone use is limited by state and will require cumbersome registration processes.

The DGCA uses the term “remotely piloted aircraft” (RPA) to describe an unmanned aircraft piloted from a remote pilot station, differentiating them from model aircraft.

Most operators will require a permit (UAOP) but nano and micro drones flying low or inside are exempted.

India Customs Duty on Drones

The customs duty structure in India for drones can be somewhat intricate, generally comprising a combination of basic customs duty (BCD), social welfare surcharge, and Goods and Services Tax (GST). The exact rates can vary based on the drone's value and type. It's worth noting that these duties and taxes can significantly increase the cost of importing a drone into India.

The customs duty structure in India for drones can be somewhat intricate, generally comprising a combination of basic customs duty (BCD), social welfare surcharge, and Goods and Services Tax (GST). The exact rates can vary based on the drone's value and type. It's worth noting that these duties and taxes can significantly increase the cost of importing a drone into India.

- Basic Customs Duty (BCD): This is the primary duty levied on imported goods. The rate for electronic items like drones can vary, but it has been in the range of 10-20% of the assessed value.

- Social Welfare Surcharge: An additional charge, usually a percentage of the BCD, aimed at financing social welfare initiatives.

- Goods and Services Tax (GST): This tax is applied on top of the cumulative sum of the value of goods, BCD, and any other applicable duties. GST rates for electronics including drones can be between 18% to 28%.

Additional Considerations

- Valuation for Duty: Customs officials determine the value of the drone based on the transaction value or by reference to similar items, which then forms the basis for calculating duties.

- Regulatory Permissions: Beyond customs duties, individuals and entities looking to import drones into India may need to secure permissions from the DGCA or other relevant authorities, especially for commercial use or if the drone falls under certain categories based on weight and capability.

Drone Classification

Before every single flight in India, drone pilots are required to request permission to fly via a mobile app, which will automatically process the request and grant or reject it.

Nano : Less than or equal to 250 grams.

Micro : From 250 grams to 2kg.

Small : From 2kg to 25kg.

Medium : From 25kg to 150kg.

Large : Greater than 150kg.

Foreigners are currently not allowed to fly drones in India.

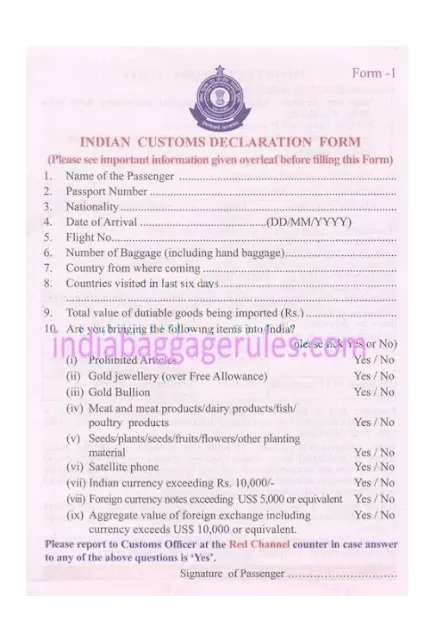

The Indian Customs Declaration Form has been revised to include drones in the list of prohibited and dutiable goods. It is now mandatory for the passengers to declare it.

Passengers entering India will now have to declare their possession of drones upon arrival. They will also have to pay an extra duty on it.

Am I allowed to bring drones into India? Will it get confiscated by airport customs or security?

There is plenty of evidence of travellers taking their drone into India, and using it. Your obligation will be to declare the drone, and head for the Red Channel when you reach customs.

India has plenty of no-fly zones especially anywhere near an international border, military areas and airport areas.

There are some instances of tourists getting arrested for flying drones.

If you want to use a drone for a event i suggest to hire one.

Trying to deal with the Indian Customs is pointless. Indian bureaucracy is not the best. It'll take you forever to get any kind of clarification, if at all.