Navigating Indian Customs: Bringing an LCD TV to India

In

today's globally connected world, traveling across borders with

electronics like LED, LCD TVs has become quite common. Whether you're

returning home to India after a stint abroad or bringing in electronics

as gifts, understanding the nuances of Indian customs duty on such items

is crucial. This guide delves into the specifics of taking an LCD TV to

India, focusing on the customs duty aspect to ensure you're

well-prepared for your journey.

Understanding Indian Customs Duty on LCD TVs

Indian customs regulations have been designed to manage the import of goods efficiently, balancing between facilitating ease of travel and curbing illegal imports. When it comes to bringing HD & LED Smart TVs into India, the customs duty policies are specific and detailed, aiming to regulate the influx of high-value electronic items.The Duty Structure

As of the latest guidelines, bringing an HDTV into India is subject to customs duty. This duty is calculated based on the value of the television. The intention behind imposing duty on electronics like High end LCD TVs is to protect the domestic market and encourage local purchasing. However, for many Indians returning home or those bringing TVs as gifts, understanding these charges is essential.

The duty rate can be a significant percentage of the Smart TV's value, which is determined based on the Invoice value or the assessed value by the customs officials if the invoice is not available. It's crucial to note that this rate is subject to change based on government policies, so checking the latest regulations before your travel is advisable.

The customs duty applicable to any television being imported into India through airports is set at 38.5% of the value of the same or a similar model available in India.

How to Declare Your LCD TV at Indian Customs

Upon arrival, if you're carrying an HD & LED Smart TV, you'll need to declare it at the customs counter. Here's a streamlined process for doing so:

Invoice and Receipt: Ensure you have the purchase invoice and receipt handy. This documentation will be critical in assessing the value of the TV for duty purposes.

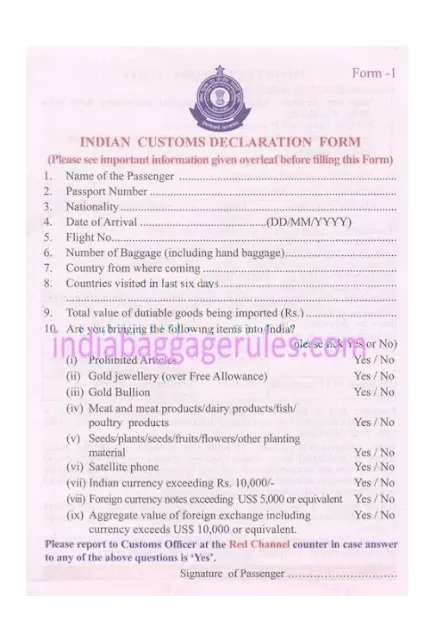

Declaration Form: Fill out the customs declaration form upon arrival, accurately declaring the LCD TV. Misdeclaration can lead to fines or confiscation of the item.

Payment of Duty: Duty payment can be made at the customs counter. Modes of payment may vary, including cash, card, or other electronic methods, depending on the airport.

Exemptions and LimitsThere are certain exemptions and limits to the amount of electronics one can bring into India without incurring customs duty. However, for high-value items like LCD TVs, these exemptions are limited. It's worth exploring if your situation qualifies for any specific exemptions, although these cases are rare.

Tips for a Smooth Process

Stay Informed: Regulations change, and staying updated on the latest customs duty rates and policies will help you avoid surprises.

Keep Documents Ready: Having your purchase invoice, warranty card, and any other relevant documentation readily available will ease the customs process.

Consider Costs: Sometimes, the cost of bringing an LCD TV to India, including customs duty, may approach or even exceed the price of purchasing the TV locally. Evaluate this aspect carefully.

Be Honest: Always declare your items honestly to avoid penalties or delays.

Final Thoughts

While bringing an LCD TV to India as part of your luggage is permissible, the customs duty imposed can significantly affect the cost-effectiveness of this decision. Being well-prepared, having all necessary documents in order, and adhering to the customs regulations will ensure a smoother experience at the airport. As always, the key is to weigh the convenience and sentimental value against the potential costs involved.